If so, you’ve come to the right place!

Our guide can equip decision-makers with a thorough understanding of business rate changes in 2023.

Whether you’re just starting out as an entrepreneur or need help determining how business rates could impact your future office space costs - we've got the answers!

What are business rates?

Business rates are collected by local authorities and are channelled into local services (in a similar way to council tax).

The rate you pay depends on the value of your property and the area that it's located in.

While business rates can seem daunting at first, it's important to familiarise yourself with them to avoid any unexpected surprises and ensure you know exactly how much they will impact the monthly costs you have to pay for office space (or other commercial property).

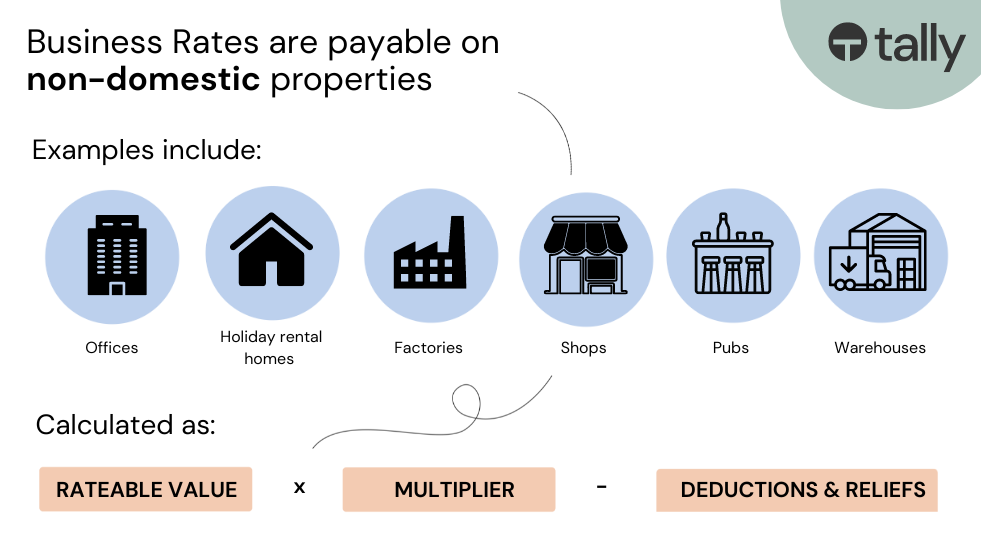

Which properties are business rates charged on?

- Offices

- Factories

- Shops

- Holiday rental homes or guest houses

- Pubs

- Warehouses

However, unfortunately, these exemptions do not normally apply to office spaces.

Do you have to pay business rates if you rent an office?

With conventional office space, business rates will be chargeable on top of the rental cost.

At Tally Workspace, we use a cost comparison table which lays out the different office costs to ensure you are 100% clear on what's included and excluded so that you can be sure that you are making the best office space decision for your budget.

Who pays business rates the tenant or the landlord?

In some cases, the landlord will include business rates in the monthly rental amount.

However, it's important to note that the bill will still be to the occupier and if unpaid the action will be against the occupier, not the landlord.

If you're a tenant, you should therefore always make sure to double-check whether business rates are included in your lease.

How much are business rates?

Less any deductions or reliefs (e.g. small business rate relief).

How are business rates calculated?

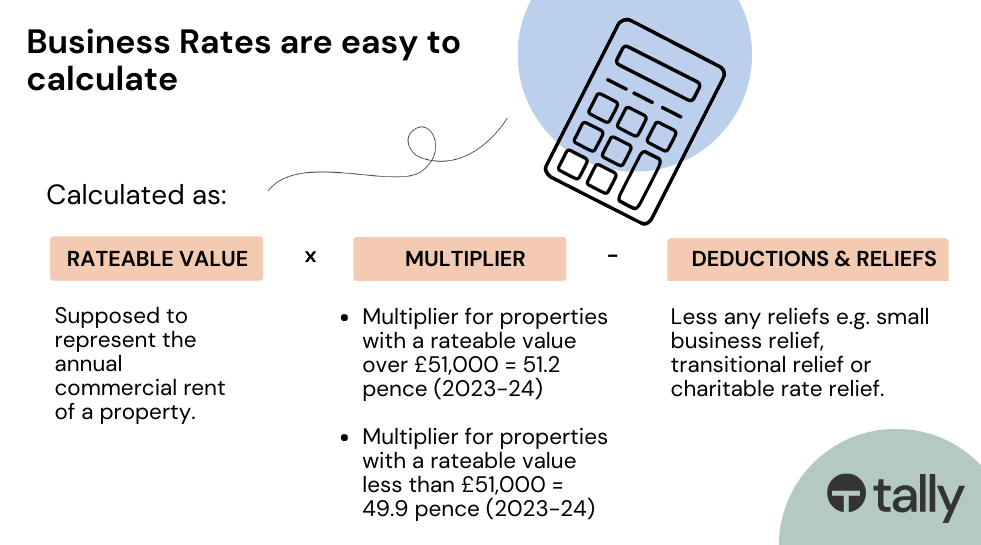

The rateable value is then multiplied by the "multiplier" - this is the amount set each year by the government, and is designed to cover the overall cost of business rates in the UK.

However, depending on your location and the type of business you run, you may be eligible for discounts, reliefs or exemptions (see what business rate reliefs are available below).

What is the rateable value of a property?

Therefore, a property's rateable value will change as the property market changes.

All rateable values are based on market values on a single date - the next revaluation will come into effect on 1 April 2023.

Overview of the business rate calculation:

2. Look up the "multiplier" for your property

For 2023 to 2024:

- Multiplier for properties with a rateable value over £51,000 = 51.2 pence

- Multiplier for properties with a rateable value less than £51,000 = 49.9 pence

4. Deduct any business rate relief.

Example Business Rates calculation for 2023

- Rateable value = £60,000 (Post code was entered into the HMRC rateable value tool)

- Standard multiplier = 51.2 pence (taken from multiplier table)

- Tax payable = £60,000 (rateable value) x £0.512 pence (multiplier) = £30,720 (business rates payable)

- Sally has no deductions from this as she is not eligible for business rate relief.

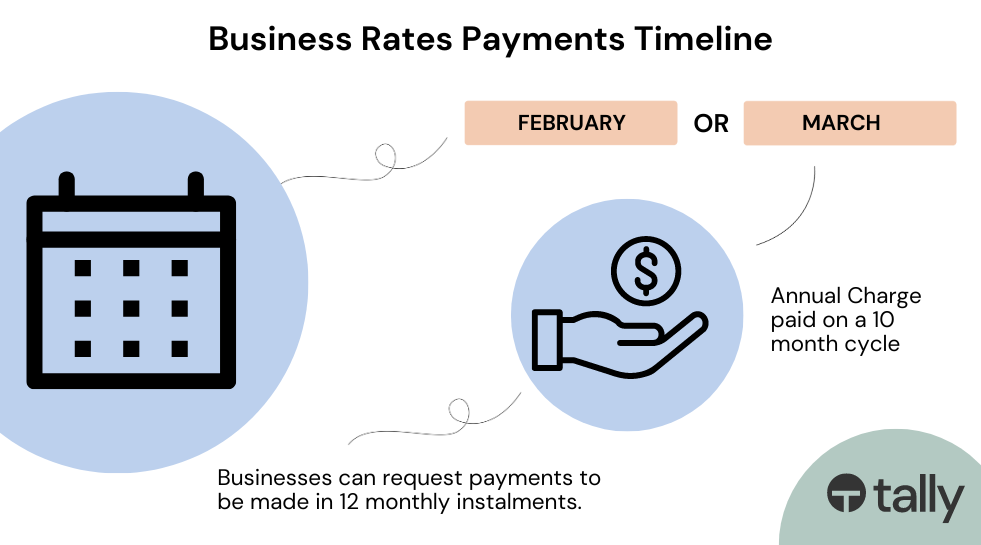

Timing of business rate payments

The amount is shown on the bill and is calculated as rateable value x multiplier less any reliefs or reductions.

The bill covers charges for the next year so it is essentially a prepayment.

Business rate bills are paid on a 10-month cycle, but there are regulations in place which allow businesses to request payments to be made in 12 monthly instalments.

What Business Rate Reliefs are available?

Small Business rates relief

As a result, if your company has a rateable value of less than £12,000 then you will be exempt from business rates.

If your business' rateable value is between £12,000 and £15,000, you may be eligible for a small business rate relief, which could significantly reduce the amount you need to pay.

However, if your business has a rateable value above £15,000, you'll be required to pay business rates.

But don't worry, there are options available to make sure you're not paying more than you need to.

So, if you're unsure of your company's rateable value or if you qualify for any relief, it's always best to reach out to your local council for guidance.

Enterprise Zone Relief

It's worth doing your research and working with a professional to ensure you're taking advantage of any exemptions that apply to your business.

Councils work out how much relief is applicable to each property and businesses can get relief of up to £55,000 a year over a 5-year period i.e. up to £275,000.

For a full list of different zones see this handy Enterprise zone map.

Transitional relief

It means that changes are phased in over time so you should not have to pay a much larger amount than you have previously.

Charitable rate relief

Non-profit organisations can also receive discretionary relief so it is worth contacting your local council to see if you're eligible.

Other business rate reliefs

- Rural rate relief

- Exempted buildings and empty buildings relief

- Hardship relief

- Transitional relief

- Retail, hospitality and leisure relief

- Local newspaper relief

- COVID-19 additional relief fund

- Nurseries discount

However, if you're unsure which apply we would recommend contacting your local council, who will be able to advise on available reliefs.

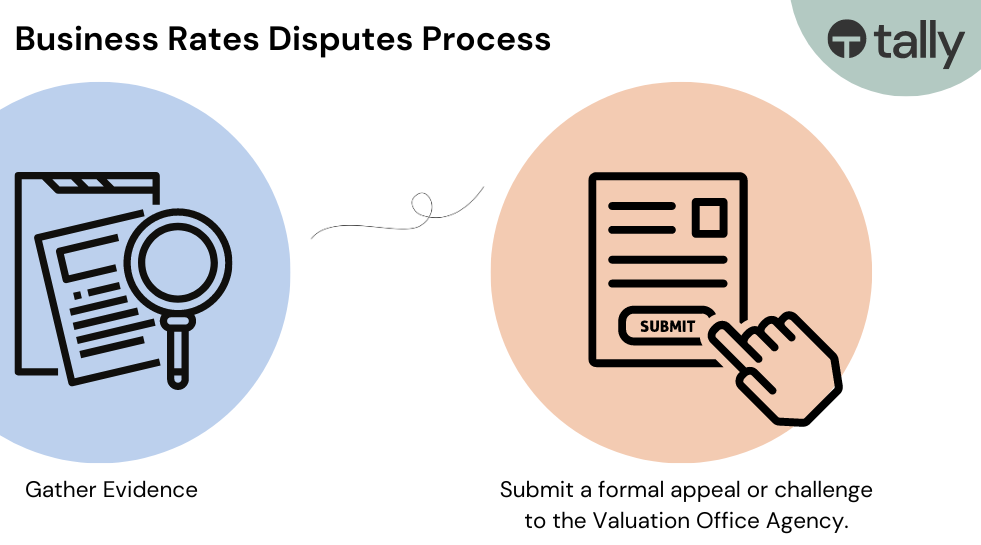

Can I appeal my business rates bill?

Fortunately, there are options available for challenging or appealing these assessments.

The first step is to gather evidence regarding the value of your property, such as recent sales or rental values of similar properties in the area.

It's also important to have a clear understanding of the valuation process and the factors that are taken into consideration.

You can then submit a formal appeal or challenge to the Valuation Office Agency.

While the process may seem daunting, it's important to remember that you have the right to question the assessment and seek a fair outcome.

With the right information and approach, you can successfully appeal or challenge the rateable value assessment of your business property.

Are business rates payable on vacant office space?

For the first 3 months, you don't have to pay business rates, but after this period, most businesses pay full business rates.

It is your responsibility to contact your local council and notify them if your property is vacant.

Business rates FAQs

Are business rates and council tax the same?

Are business rates paid monthly?

However, there is a government regulation that allows ratepayers to be able to request from their local authority to make payments through 12 monthly instalments.

Are business rates increasing?

To prevent large increases in business rates the government has a "transitional relief scheme" which is aimed at phasing bill increases in gradually.

Are business rates exempt from VAT?

Where should I go for advice on business rates?

However, if you're seeking advice members of the Royal Institution of Chartered Surveyors (RICS) are a good place to start as they are qualified in the area.

Navigating the complexities of UK business rates can feel overwhelming, especially when you're focused on steering your business toward success.

But with the right knowledge and tools at your disposal, you can make informed decisions that help you manage your office space costs effectively.

Whether you're just starting out or managing a large portfolio, understanding how business rates impact your budget is crucial.

From cost comparison tables to expert advice, we ensure you have all the information you need to choose the best office space for your business — without any hidden surprises.

Ready to make a smart office move?

Explore our range of workspaces and find the perfect fit for your team today.