Tuesday 28th January 2025

Can You Claim Tax Relief for Hybrid Working?

Wondering if you can still claim tax relief for hybrid working? You're not alone.

As more businesses embrace a mix of in-person and remote work, many employees are questioning how the tax relief rules apply to them.

In fact, in July 2024, 35% of workers said they’re hybrid workers, splitting their time between home and the workplace.

That’s why, here, we'll break down everything you need to know about the working from home tax relief, how to claim it, and whether you qualify under the latest HMRC guidelines.

What is the working from home allowance?

Simply put, the working from home allowance is a tax relief provided by HMRC to help employees cover the additional costs of working from home. like heating, electricity, and business phone calls.

It’s been around since the 2020 lockdown, when HMRC introduced several tax reliefs to support those working from home.

The working from home allowance was a hot topic during Covid-19, with millions across the UK claiming it, resulting in costs of £500m over two years.

How much can you claim from HMRC for working from home?

The working from home tax relief, AKA the 'Working from Home Allowance,' is a handy benefit worth up to £125 a year.

It’s designed to help cover the extra costs that come with working from home.

You can claim a flat rate of £6 per week in tax relief without needing to submit expenses or figure out exactly how much of your heating and electricity goes towards work.

If your costs are more than £6 per week, you can claim tax relief for a larger amount, but you’ll need to provide evidence (like invoices or receipts) to prove these costs were solely for business purposes.

What’s the working from home tax relief for 2023/24?

Still £6 per week, working out as £26 per month, up to £125 per year.

It may increase for 2025-26, but those figures aren’t available from HMRC just yet.

What is the HMRC working from home allowance for 2024-25?

At the moment, HMRC says the WFH allowance for 2024-25 is still £6 per week, up to £125 per year.

But that could increase for the year 2025-26.

Am I eligible to claim Working from Home tax relief?

HMRC has a simple tool that helps you find out if you’re eligible for a tax rebate for working from home by answering just a few questions.

Your eligibility for tax relief can vary depending on whether your employer reimburses you for the costs of working from home.

If your employer doesn’t cover these costs, the rules for claiming relief are much stricter.

1. If the employer reimburses the cost of homeworking

Employers can make tax-free payments to help cover the extra costs of working from home, meaning they’re not subject to income tax or national insurance.

To qualify for these expenses, HMRC requires that both of the following conditions are met (from section 316A ITEPA 2003):

- There must be an arrangement between you and your employer.

- You must regularly work from home under this arrangement.

HMRC explains that this applies even in hybrid or flexible working setups, like working from home two days a week (even if the days vary).

While the agreement doesn’t need to be in writing, it’s a good idea to have something documented to show that working from home is part of your regular routine.

2. If the employer does not reimburse the cost of homeworking

The exemption above only applies to expenses reimbursed by your employer.

If that’s not the case, you’ll need to meet much stricter requirements under section 336 ITEPA 2003.

HMRC has made it clear on their website that you can’t claim the working from home allowance if you choose to work from home.

Here’s what HMRC means by “choosing to work from home”:

- If your employment contract allows you to work from home some or all of the time.

- If you work from home because of Covid-19.

- If your employer has an office, but it’s sometimes too full for you to work there.

In addition to not choosing to work from home, one of the following must also apply:

- There are no appropriate facilities available for you to do your job at your employer's premises.

- The nature of your job requires you to live so far from the office that daily travel isn’t reasonable.

In most cases where hybrid work has been adopted and additional costs aren’t being reimbursed, employees will no longer be able to claim working from home tax relief.

What can I claim tax relief on?

HMRC makes it clear that the expenses you claim tax relief on should only be related to your work — things like business phone calls and gas or electricity for your work area.

They also note that you can’t claim for expenses you’d have anyway, like rent or broadband access.

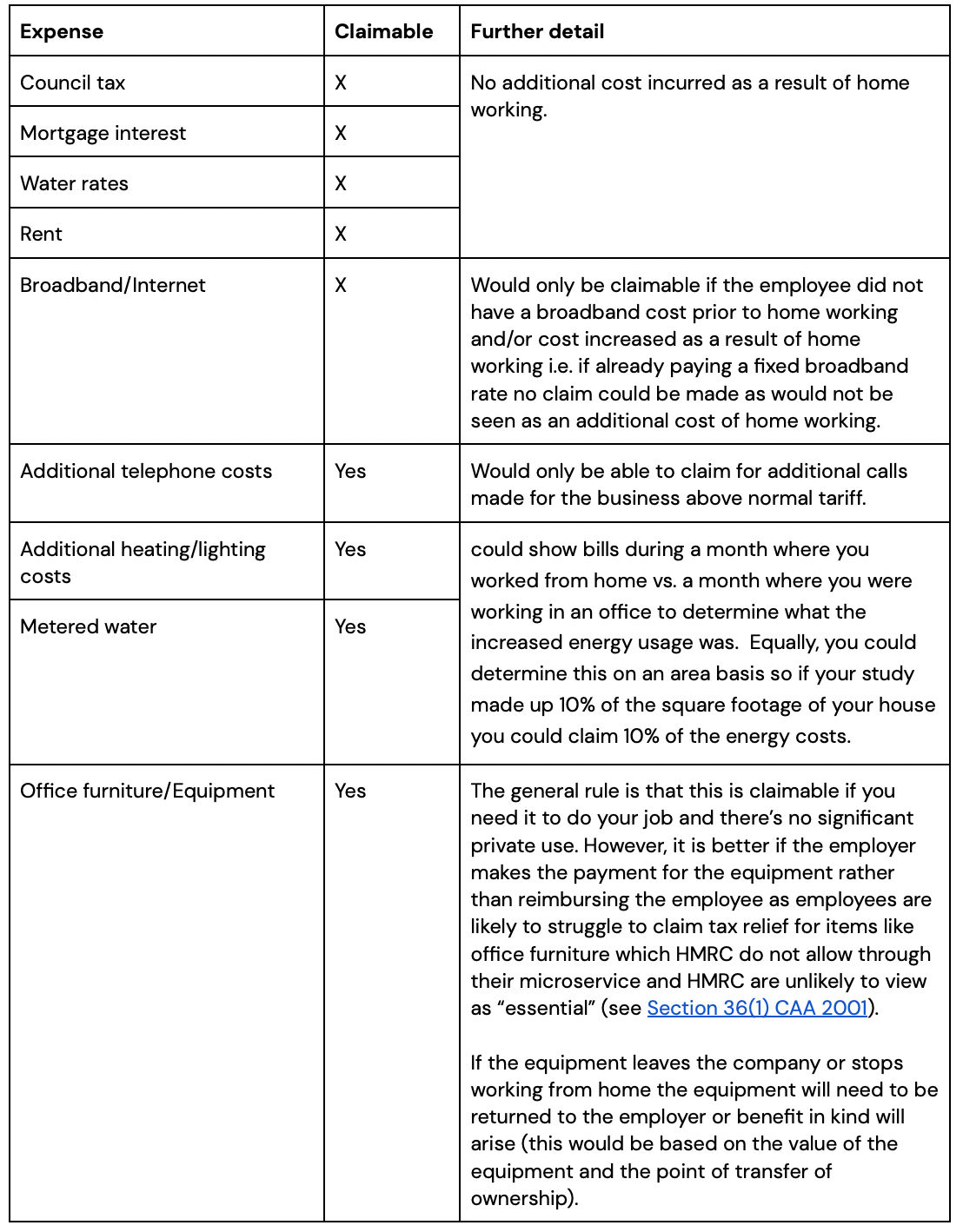

The table below gives more detail on the specific expenses HMRC lists and what’s required to claim them.

As long as any private use is minimal and your employer is providing something (like office furniture, equipment, or an internet connection) to help you do your job, this can be done without creating a tax liability for you.

Here's a full breakdown, from Section 36(1) CAA 2001 of the HMRC guidelines:

If you decide to claim more than the £6 weekly allowance, HMRC may ask for evidence of your additional costs.

You’d need to prove the extra expenses — for example, by comparing bills from a month when you worked from home to a month when you were in the office to see the difference in energy usage.

Or you could calculate this based on the area of your home; if your study takes up 10% of your house’s square footage, you could claim 10% of the energy costs.

A word of caution: property owners usually avoid claiming business expenses related to their energy or household costs.

Doing so could mean that the part of your home used solely for business might lose its eligibility for Capital Gains Tax relief.

This could have significant tax implications, especially if your home is your primary residence.

Can you claim gas and electric working from home?

Yes, according to HMRC, you can claim gas and electricity for your work area.

But it’s worth remembering that this is only in the form of the working from home tax relief — £6 per week, up to £125 per year — so not your entire gas and electricity bill while you’re working from home.

How to claim your work from home tax relief

There are two ways you can claim your working from home tax relief claim from the HMRC:

Option 1: Employee claims tax relief

In most cases, businesses don’t cover home working expenses directly, so employees need to claim the relief themselves.

You can do this through your self-assessment tax return if you complete one, or by using the HMRC portal.

If you’re claiming up to £6 per week, you won’t need to submit any supporting documents — just claim the flat rate.

Be sure to double-check your payslip first.

If your employer is already covering your home working expenses or paying you a working from home allowance, you shouldn’t submit a claim as that would mean double claiming.

If you’re unsure, it’s best to check with your payroll administrator.

Option 2: Employers pay an additional £6 per week

Employers can pay their employees £6 per week, tax-free, to cover the extra costs of working from home.

No records are needed as long as the payment is kept to £6 or less per week.

This can be processed through payroll, but make sure it’s set up to exclude tax and pension deductions in your accounting software.

If the claim exceeds £6 per week, the process is the same, but the employer will need to keep records and supporting documents, such as invoices and contracts, to back up the amounts claimed.

How do I calculate my home office expenses for tax relief?

Calculating your home office expenses for tax relief is pretty straightforward.

If you’re claiming the standard allowance, there’s no need to do any calculations — you can claim a flat rate of £6 per week without needing to provide any documentation.

But if your expenses are higher and you want to claim more, you’ll need to keep track of your bills.

For example, compare your energy bills from when you’re working from home versus when you’re in the office.

You can also calculate based on the space you use for work; if your home office takes up 10% of your home’s square footage, you can claim 10% of your energy costs.

Just be sure to keep all your receipts and invoices handy!

What are the tax implications of hybrid working?

Hybrid working can have some tax implications, especially when it comes to claiming tax relief.

If you split your time between home and the office, you might still be eligible for the working from home tax relief.

However, to qualify, your employer needs to require you to work from home as part of your job, not just as a personal choice.

If that’s the case, you can claim a flat rate of £6 per week to help cover the extra costs, like heating and electricity, even if you’re only working from home part-time.

Can I claim work from home tax relief for previous years?

Yes, you have until 5 April 2025 to claim the 2020/21 working from home allowance and until 5 April 2026 to claim for the 2021/22 tax year.

If you’ve had to work from home for any part of the week, you might be eligible to claim tax relief for the additional costs.

Can I claim tax relief if I work from home part-time?

Yes, you can claim tax relief if you work from home part-time, as long as you meet HMRC’s eligibility criteria.

To qualify, your employer must require you to work from home regularly as part of your job, even if it’s just a few days a week.

The key is that working from home is not simply by choice but is part of an arrangement with your employer.

If you meet these conditions, you can claim the standard working from home allowance of £6 per week, even if your home working is part-time.

When did working from home allowance stop?

On 6 April 2022, HMRC made it clear that if you claimed tax relief for working from home due to coronavirus, you might not be eligible anymore.

With no legal requirement to work from home, most hybrid workers are no longer able to claim this relief since it's now a choice rather than a necessity.

While there is still a tax relief available for people who work from home, many employees simply don’t match the criteria.

Navigating the world of tax relief for hybrid working can be a bit tricky, but understanding the rules can help you make the most of the benefits available.

Whether you're working from home full-time or just a few days a week, knowing what you can claim and how to claim it is key to ensuring you're not missing out.

As hybrid working continues to evolve, having the right workspace becomes even more important.

If you’re ready to find the perfect office space that fits your team’s needs — whether it's flexible, collaborative, or somewhere that feels like home — Tally Workspace is here to help.

Find your ideal workspace today and let’s make sure your team has the environment they need to thrive, whether they’re in the office, at home, or anywhere in between.

Written by Laura Beales